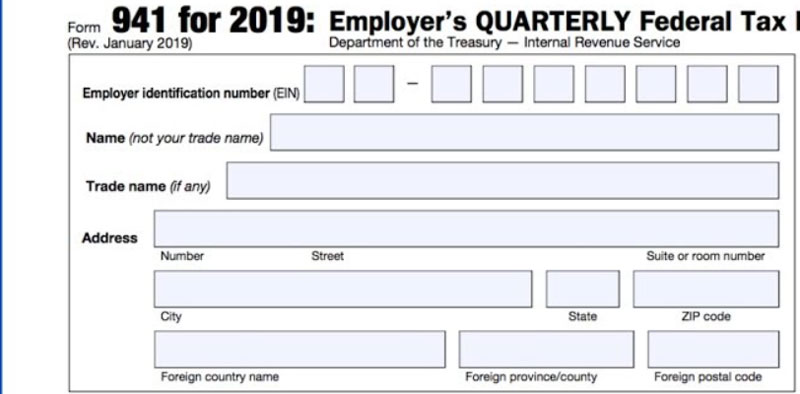

The payroll form known as Form 941 is to disclose the federal taxes the employer has

deducted from employee remuneration throughout the quarter.

The form needs to be submitted every quarter. It is necessary to perform a computation to determine the total amount of taxes and contributions for the period. The issue is the amount that is considered owed and must be paid.

The electronic submission option is available to employers. The Internal Revenue Service Form 941 comprises six pages and five sections. At the top of page 1, the employer must write their name, address, and employer identity card.

If a trading name is used, this must also include the trade name (EIN). Additionally, the employer denotes the filing period as follows:

- First quarter of year

- Second quarter of year

- The third quarter of a year

- Fourth quarter

Part One

In Part One of the tax return, the employer must state the total number of employees, their pay, and the amount of tax that is payable. This section also indicates if the employer has underpaid or overpaid employment taxes and whether or not the employer owes taxes.

Any amount paid more than required can either be carried over to the following period or refunded. The option selected can be seen by ticking the box on Line 15 that corresponds to it.

Part Two

The schedule for making tax deposits related to employment taxes is discussed in Part Two, which starts in the middle of the second page. The frequency of deposits is typically once a month or every two weeks for most employers.

If you are making monthly deposits, enter your monthly tax liability breakdown here. Employers who make tax deposits every two weeks must use Schedule B to account for the tax liabilities associated with their deposits.

For tax payments that are more than $100,000, the deposit must be made the following business day. Taxes with a total liability of less than $2,500 may be paid using the form and do not require a deposit.

Part Three

In Part Three, the employer is required to respond to two questions: first, must the firm have shut down or ceased paying salaries (together with the date on which this occurred), and second, must the business be considered a seasonal employer?

Part Four

In the fourth section of the form, the employer is questioned about whether or not they would provide permission to an employee, a paid income tax preparer, or another related party such as a Certified Public Accountant (CPA) to discuss the return with the IRS.

If the answer is affirmative, the employer must disclose the name, phone number, and personal identification number to the Internal Revenue Service (IRS) so that the IRS may verify the person's identity.

Types of Taxes

In Part One of the form, the employer is responsible for reporting the total amount of taxes paid on salaries, tips, and other forms of compensation. There are four distinct categories of taxation:

Contributions to Social Security The total tax burden, which includes payments from both employees and their employers, are subject to a rate of 12.4%.

Medicare taxes. The rate, which accounts for employer and employee contributions, is 2.9 percent.

Taxes for Medicare and those already paid on compensation over $200,000. The tax rate for employees is 0.9%, and they are completely responsible for paying the tax.

Line Items on Form 941

Those few lines of Form 941 require companies to input the following: the number of employees who earned pay, tips, or other payment; total wages, tips, and other compensation; and the federal taxes withheld.

There are separate line items to record qualifying sick and parental leave wages and the COBRA premium credit, a component of ARPA. The current 2022 draught version of Form 941 features a few line items that suggest they are preserved for future use.

The 2022 draught Form 941 includes a total of 28 lines. For reference, the 2019 Form 941 has a total of 18 lines. Because of the COVID-19 outbreak, the IRS has updated Form 941 to include new lines and changes.

The draught 2022 Form 941 instructions state that the COVID-19 associated credit for qualified sick and parental break pay is restricted to the time taken after March 31, 2020, and before October 2021.

The guidelines also state that the ERC has ended (September 30, 2021) for most companies. If the employee is recovering startup business, the expiry date is December 31, 2021. In addition, the instructions state that the credit for COBRA premium minimum payment terminated after September 30, 2021.

Understanding Sales Tax on Used Cars: What Buyers Need to Understand

The 2023 Top Advantage Plans for Medicare

Will A Lease Break Damage Your Credit?

The Risks of Inaction: What Happens If You Don't Activate Your Credit Card?

All About the Cheap Car Insurance in New Jersey

View Authorized User Purchases

How to Find the Best Listing Agent: Everything You Need to Know

Work for Labor Day Bargains

How to Request a Quote From a Car Dealer: All You Need to Know

In-depth Details To Know About VA Construction Loans

An Extensive RedfinNow Review 2023